Monday, 31 August 2020

Liberty University To Investigate Jerry Falwell Jr's Tenure As President

source https://www.huffpost.com/entry/liberty-university-investigate-jerry-falwell-jr_n_5f4d86b0c5b697186e3a12ac

Why Did Justin Bieber Buy in Beverly Park? A Huge Discount Didn’t Hurt!

realtor.com, Alberto E. Rodriguez/Getty Images

Pop star Justin Bieber and his wife, model Hailey Baldwin, just bought a posh property in the Beverly Park neighborhood of Beverly Hills, CA, for $25.8 million, according to Variety.

The high price is actually a serious discount from when the property debuted on the market two years ago. At a list price of $42 million, it was our most expensive new listing of the week.

Built in 1988, the estate was completely renovated before its April 2018 debut. At the time, listing agent Christopher Dyson called it “reimagined to an exacting standard.

“To have a practically brand-new, move-in ready opportunity, in what many consider to be the most exclusive community in the city, is very special,” he said.

Special, yes, but buyers weren’t enticed. The price was slashed to $38.5 million in late 2018, dropped to $34.8 million at the beginning of 2019 and then $29.5 million late last year. Last month, it was relisted for $27.25 million.

Bieber’s $25.8 million sale price represents a 39% discount from the 2018 price.

Picture-perfect property

And since its initial renovation, the home has undergone another makeover. It’s now “completely updated to 2019 standards with state-of-the-art amenities throughout,” according to the listing.

New staging with contemporary furnishings in a neutral palette also made the home much more appealing.

Set behind gates on 2.5 acres, the 11,000-square-foot home has seven bedrooms and 10 bathrooms.

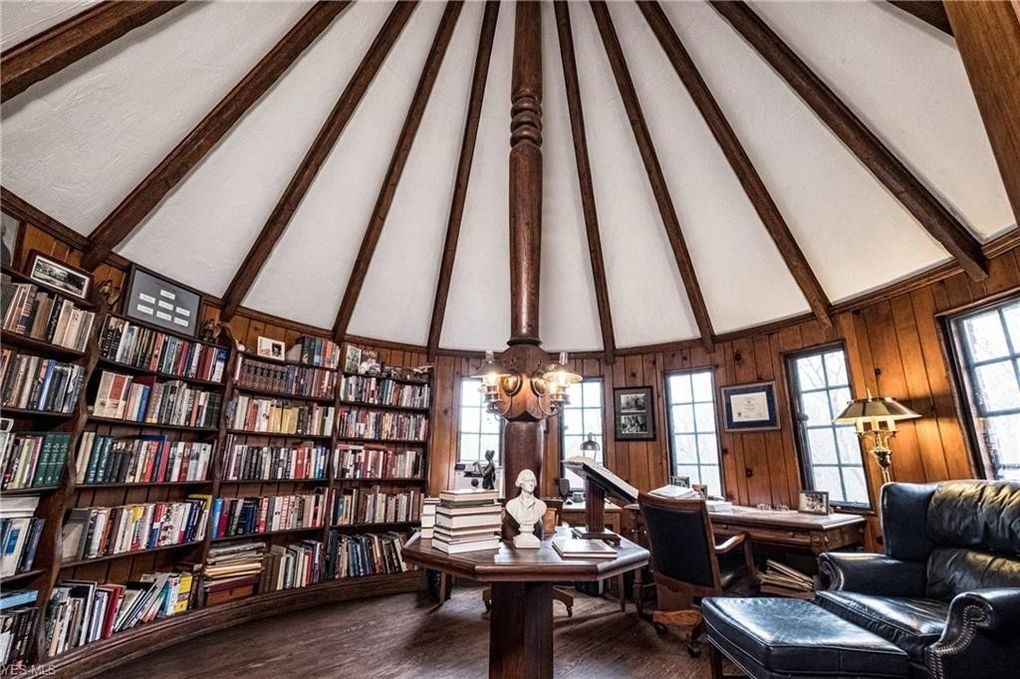

The layout includes a gallery foyer, large living room, den, library, and formal dining room. The eat-in kitchen comes with top-of-the-line appliances and is adjacent to a family room. Walls of glass open to the patios and lawn.

Upstairs, you’ll find six bedrooms and the master suite. The latter comes with a sitting area, dual closets and bathrooms, and heated floors.

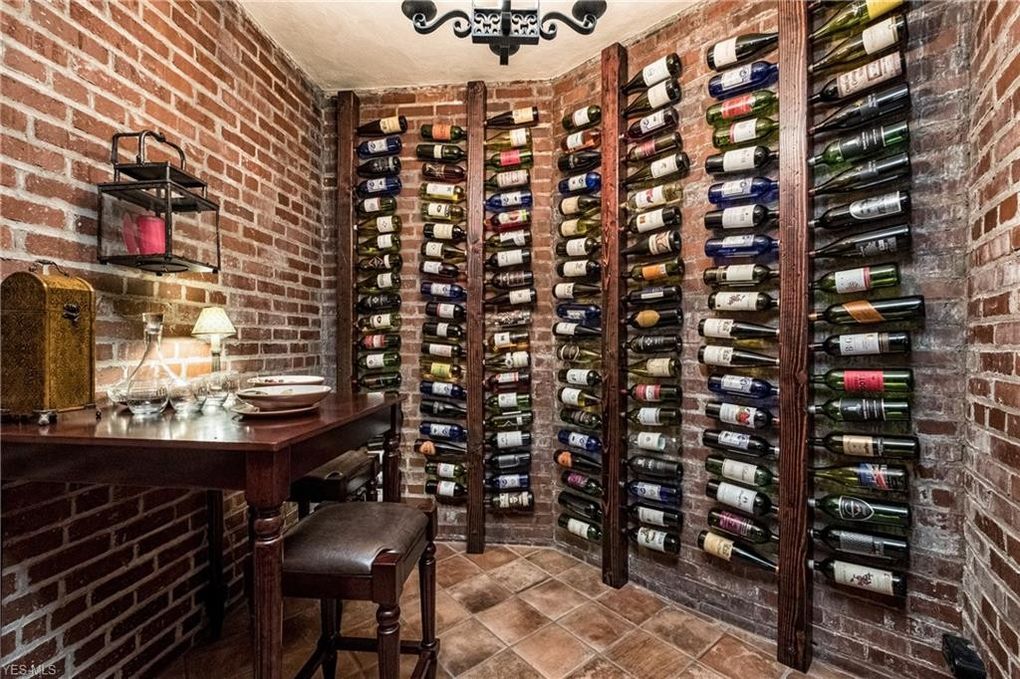

The floor plan also includes a home theater, wine cellar, and gym.

The grounds feature a grassy lawn, koi pond, infinity pool, tennis court, lounging and dining space with a barbecue and pizza oven.

The home is “perfect for large scale entertaining” and is “completely private and secluded”—a big plus for the paparazzi targets—according to the listing.

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

The perks of Beverly Park

The upscale community of Beverly Park is considered one of the “most exclusive, expensive places in Los Angeles,” according to the Wall Street Journal.

It’s primarily known for its celebrity inhabitants and big houses, with each property boasting “a minimum of 2 aces with the most beautiful grounds,” says listing agent Sally Forster Jones with Compass. “It provides a private, quiet community away from the city hustle, but is also just minutes from the best of Beverly Hills.”

It’s the neighborhood where a massive mansion and vineyard owned by Vanna White were recently sold for $19.3 million.

It’s also the location of the most expensive home in the country, currently listed for a jaw-dropping $160 million.

“North Beverly Park is one of the most prestigious enclaves in Los Angeles,” says Tomer Fridman of Compass. “Being behind gates, surrounded by discreet and high-end neighbors, and having the luxury of secluded, large-lot estates comes at a premier value.”

Bieber is just the latest celebrity to put down roots in the exclusive enclave, which has reportedly been home to folks such as Denzel Washington, Sylvester Stallone, and Sofia Vergara.

Located in the southern section of Beverly Park, Bieber’s home is close enough for the couple to borrow a cup of sugar from the likes of Samuel L. Jackson, Magic Johnson, and Prince Alex von Furstenberg, according to Variety.

“It draws celebrities and high-profile individuals because of the maximum privacy. The community is guard-gated, with most personal residences providing additional gates, and any guests must be invited and screened to enter,” says Jones.

Fridman also touts the location: “Being in close proximity to either studios and meetings in the San Fernando Valley or to a night out of city entertainment in Hollywood or Beverly Hills makes Beverly Park a highly sought-after location.”

Real estate redux

Bieber and Baldwin reportedly purchased a place in Beverly Hills last year for $8.5 million.

After years of renting, Bieber became the proud owner of a 6,132-square-foot property with five bedrooms and seven bathrooms. The home has a number of perks, including a wine cellar, library, and home theater. The grounds feature an infinity pool and fire pit.

View this post on InstagramA post shared by Hilton & Hyland (@hiltonhyland) on

It was the first place Bieber had owned in the U.S. since 2014, when he sold his Calabasas mansion to reality TV star Khloe Kardashian after an infamous egg-throwing incident made him persona non grata in the neighborhood.

As a renter in Beverly Hills, he was dubbed “Worst Neighbor Ever” and banned, at least for a time. But he returned to the 90210, first as a short-term renter in the so-called “Salad Spinner” house. He then rented again, paying a reported $55,000 a month for a Beverly Hills contemporary.

For five years the pop star bounced from one rental to another, including a place he and Baldwin rented for a whopping $100,000 a month in San Fernando Valley. The couple made a hasty retreat after serious plumbing problems surfaced at the home.

Kurt Rappaport represented the seller. Joshua Altman with Douglas Elliman represented the buyer.

The post Why Did Justin Bieber Buy in Beverly Park? A Huge Discount Didn’t Hurt! appeared first on Real Estate News & Insights | realtor.com®.

source https://www.realtor.com/news/celebrity-real-estate/why-did-justin-bieber-buy-in-beverly-park-huge-discount-didnt-hurt/

Reebok Founder Paul Fireman Sells Massachusetts Mansion for $23M

Douglas Elliman

Reebok founder Paul Fireman has sold his lavish estate in Brookline, MA, for $23 million—after four years and multiple price cuts. The 27,000-square-foot mansion comes with 7 acres. An additional 7 acres adjacent to the property is still available.

While one of the priciest homes on the market for the area, the sale price represents a steep discount from the initial ask in 2016. That year, the custom-built home was listed for $90 million, which eventually landed it on our list of the 10 most expensive homes on the market in 2017. In early 2019 the home was relisted for $69 million, then reduced to $38 million late last year. The home was most recently listed for $33 million.

Built for Fireman in the late 1990s, the home was completed in time for the 1999 Ryder Cup golf tournament, which took place at the adjacent country club. Fireman and his wife, Phyllis, enjoyed the elegant estate for almost two decades.

Designed by the architecture firm Shope Reno Wharton, the mansion features Indiana limestone and melds traditional architecture with modern luxury.

Douglas Elliman

Douglas Elliman

Douglas Elliman

Douglas Elliman

Douglas Elliman

Douglas Elliman

Douglas Elliman

Douglas Elliman

Douglas Elliman

The mansion comes with eight bedrooms, seven bathrooms, and five half-baths, and it boasts a glorious natural setting just five miles from downtown Boston.

The grand entrance hall features a domed ceiling and curved staircase. The space flows to the formal living and dining rooms. The library, billiard room, and study are all wood-paneled. The master suite takes up the second floor, with two closets, a bathroom, exercise room, and study.

Other notable features include classical columns, wrought-iron balconies, ornate fireplaces, and a wine cellar.

Outside, a 5,000-square-foot terrace allows for entertaining.

The mansion is just down the road from Tom Brady and Gisele Bündchen’s vacant mansion. The couple listed their custom-built mansion before the quarterback’s move to the Tampa Bay Buccaneers, but it has since come off the market.

George Sarkis and Manny Sarkis, founders of the Sarkis Team at Douglas Elliman, held the listing.

According to George, a detailed explanation of the property was part of the winning strategy. “We also brought the builder, ThoughtForms, through the house with the buyer to intelligently explain the home, its materials, and finishes at a high level,” he says. “According to ThoughtForms, ‘It’s what you don’t see that cost the most and makes this home truly special.’”

The buyer appreciated that “the home truly was a timeless masterpiece,” adds George.

The locale was also a draw. “The buyers wanted to be close to downtown and close to some of the best private and public schools for their children,” says George.

The Sarkis Team with Douglas Elliman represented the seller. Terrence Maitland with LandVest represented the buyer.

The post Reebok Founder Paul Fireman Sells Massachusetts Mansion for $23M appeared first on Real Estate News & Insights | realtor.com®.

source https://www.realtor.com/news/celebrity-real-estate/reebok-founder-paul-fireman-massachusetts-mansion-sells/

As Louisiana Recovers From Hurricane Laura, Here’s What Homeowners Should Know About the Fine Print in Their Insurance Policies

Getty

As residents of Louisiana begin to assess the damage wrought by Hurricane Laura, some homeowners may be disappointed to learn that their insurance won’t cover all of their losses.

An early estimate from property data firm CoreLogic suggests that Hurricane Laura caused between $8 billion and $12 billion in insured losses for residential and commercial properties in Louisiana and Texas. Hurricane Laura made landfall in Louisiana on Thursday as a Category 4 storm—the 10th strongest tropical storm to ever hit the United States.

While the magnitude of the damage is stunning, it’s far less than other storms that have battered those states, including Hurricanes Katrina and Harvey. And luckily for many residents, forecasters’ fears of an “unsurvivable” storm surge didn’t fully come to fruition. Only $500 million of the estimated insured losses was due to storm surge, according to CoreLogic.

But as homeowners will soon discover, how much money they get back from their insurance company to rebuild will depend on what coverage they had and the specifics of their policy.

During a tornado, for instance, if high winds cause roof damage that leads to significant water accumulation within the house, most insurance policies will cover it. But if a nearby river crests because of the storm’s heavy rainfall and then causes flooding, the damage to homes will only be covered if the owners have flood insurance.

Damage caused by flooding isn’t covered by standard home insurance policies. Only homeowners who bought separate flood insurance for their homes were covered if storm surge destroyed their homes in coastal Louisiana. Meanwhile, if a home was damaged by the strong winds that came with Hurricane Laura, standard insurance policies will cover the damage, but homeowners will first need to pay out a deductible—a set amount of money a policyholder must pay before coverage kicks in.

Louisiana is one of the 19 states, plus the District of Columbia, where insurers can impose a hurricane deductible. Windstorm and hurricane deductibles vary from policy to policy, but are usually assessed as a percentage of the home’s overall value. In many cases, the deductible for a named storm will be more than the standard deductible.

Buying additional insurance policies for disasters like floods and earthquakes might seem like a no-brainer, but it’s an expensive proposition.

“They have to do a cost benefit analysis,” said Michael Crowe, co-founder and CEO of Clearsurance, a site where consumers can review and compare insurance companies.

The average annual premium for a policy through the National Flood Insurance Program was $699. But flood insurance premiums can easily cost thousands of dollars in regions that are determined to be at the highest risk of flooding.

Coverage for other disasters operates similarly to hurricanes. In volcanic eruptions, damage caused by lava flows or resulting fires is covered by a standard homeowner’s policy, but if the eruption causes seismic activity, homeowners will not be reimbursed unless they have purchased a separate earthquake policy.

What is covered under a standard homeowner’s insurance policy

Some natural disasters are almost always covered by homeowner’s insurance, including wildfires and hail storms. But other natural disasters are never or rarely covered under a standard homeowner’s insurance policy. They generally fall into two categories: floods and “earth movements.”

The first category comprises disasters caused by rising water, which includes everything from floods caused by extensive rainfall and hurricane-induced storm surges to dam failures and tsunamis. “Earth movements” include disasters such as earthquakes, landslides and sinkholes.

Unfortunately, many Americans are unaware that these disasters are not covered by a standard homeowner’s policy, according to the Insurance Information Institute.

Certain natural disaster typically aren’t covered because of the level of the destruction they create, said Lynne McChristian, a spokeswoman for the Insurance Information Institute and executive director of the Center for Risk Management Education and Research at Florida State University.

With these disasters, “the damage is usually so widespread, and it’s typically a total loss,” McChristian said. “Insurance companies can’t price it appropriately to make it a viable line of business for them.”

How to get to the front of the line when you need help

Regardless of whether or not a homeowner has insurance coverage for a specific natural disaster, getting their property assessed is critical in beginning the rebuilding process.

Following a natural disaster, a consumer’s first step should be to contact their insurance agent or company immediately. That is critical because insurance claims are handled on a triage basis, McChristian said.

“Those with the most damage get to the front of the line because those people have the most need for recovery assistance,” McChristian said.

By clarifying how to file a claim and conveying the state of their property, homeowners can improve the chances of having their case handled more quickly by their insurer. Homeowners should also learn the ins and outs of how to file their claim, including what information is needed and how long they have to file. Now is also the time to determine what their policy’s deductible is.

Make a head-start on assessing damage

The insurance company will send its own adjuster free of charge to inspect the property and assess the total cost of the damage. Homeowners can take steps to prepare for this by documenting what was damaged or destroyed by the natural disaster, getting bids from contractors and keeping track of receipts for any expenses they incur following the storm. Homeowners shouldn’t hesitate to make temporary repairs to protect their property from further damage.

A pricier option: Hire a third-party insurance adjuster to assess their property. Given the backlog insurers will experience following widespread disasters, it can take a while to receive a payout. To expedite this process, a homeowner can choose to hire an independent or public adjuster to assess their property.

Studies have shown that hiring public adjusters leads to higher insurance settlements. But these professionals don’t come cheap—they generally charge a fee that’s anywhere from 10% to 20% of the insurance settlement. And it’s critical to hire a reputable professional. (Check the websites of the National Association of Independent Insurance Adjusters and the National Association of Public Insurance Adjusters.)

Always have someone look at damaged property

And even if homeowners aren’t covered for flood insurance, they should still have their insurance company assess their property and whatever damage occurred.

Crowe has experienced this firsthand. In 2006, an extended period of rainfall in Newburyport, Mass., where Crowe and his family lived, caused their newly remodeled basement to flood. However, their insurance policy did not include flood coverage. He thought he would have to pay for all the damage.

But when insurance adjusters inspected the property, they noted that the basement’s sump pump—designed to prevent water accumulation—had failed.

In other words, he got lucky. The insurance company categorized the damage as the result of a mechanical failure rather than a flood, so the company covered the damage.

“I thought to myself, ‘I’m really fortunate to have insider knowledge,’” Crowe said.

The government provides flood insurance

In the case of insurance for flooding, the federal government has stepped in. The National Flood Insurance Program was created in 1968 after insurance companies struggled to pay off claims following a slew of floods in the 1950s. Homeowners have the option to buy flood insurance through this program or to get a private insurance policy. In certain cases, homeowners may be required to purchase flood insurance by their mortgage lender if their home is located within a flood zone.

Private flood insurance now accounts for roughly 15% of all flood premiums nationwide, according to the Insurance Journal. And for many homeowners, a policy from a private insurer rather than through the federal insurance program could be cheaper. One briefing from Milliman found that private flood policies would have lower premiums for 77% of all single-family homes in Florida, 69% in Louisiana and 92% in Texas.

Earthquakes

Similarly, homeowners will need to purchase a separate policy or a rider to their standard home insurance policy from a private insurer to be covered for an earthquake. California residents also have the option to purchase coverage through the California Earthquake Authority. That said, if an earthquake causes a house fire, some damage might be covered by the standard policy alone.

Sinkholes

As for sinkholes, coverage options vary from state to state. A standard home insurance policy may cover minor damage caused by a sinkhole—but catastrophic damage (generally defined as damage to more than half of the structure) is excluded. People can either get sinkhole insurance in the form of a stand-alone policy or an endorsement (also called a rider) to the standard insurance policy, depending on where they live.

Tennessee and Florida require insurers to offer optional sinkhole coverage. Insurers in Florida are also required to provide insurance for “catastrophic ground cover collapse” through their standard policies.

Did the homeowner take care of the property?

The property’s upkeep can also play a role in whether or not damage caused by a storm or other natural disaster is covered. For instance, if winter storms cause an ice dam to form on the roof of the home and the owner is not proactive about removing it, the insurer may choose to deny coverage for water damage.

You have some options if you skip insurance

If homeowners don’t buy specialized insurance coverage and then get hit by some sort of disaster, they do have some options to offset their losses. They can get a grant from the Federal Emergency Management Agency or a loan from the Small Business Administration.

“Those are not designed to bring you back to a pre-disaster condition—they’re designed just to get you back on your feet,” McChristian said. “Insurance is designed to get you back to where you were before the disaster occurred.”

How to decide whether you need coverage

For starters, homeowners need to consider whether or not they are at risk. They should check government flood zone maps. They are generally available from county governments, or you can search by address on the FEMA website. But they aren’t foolproof because they are only periodically updated.

Other factors to consider include the property’s elevation (if it’s at or just a few feet above sea level it’s more prone to flooding) and whether there has been a lot of construction in the area. This could displace vegetation that would soak up rainfall and prevent flooding.

As for earthquakes, homeowners shouldn’t assume they’re not at risk just because they don’t live on the West Coast. Earthquakes have caused damaged in all 50 states at some point since 1900, according to the Insurance Information Institute (a trade group that of course has a vested interest in people getting insurance). And fracking for oil and natural gas has led to seismic activity in parts of the country that had never before experienced it.

The post As Louisiana Recovers From Hurricane Laura, Here’s What Homeowners Should Know About the Fine Print in Their Insurance Policies appeared first on Real Estate News & Insights | realtor.com®.

source https://www.realtor.com/news/trends/what-homeowners-should-know-about-the-fine-print-in-their-insurance-policies/

‘Friends’ Star Matthew Perry Lists His Malibu Beach House for $15M

realtor.com, Dave Benett/Getty Images

Want to be a friend to Matthew Perry? Purchase his “kick-ass Malibu home,” as he called it on social media. The “Friends” star is selling his beachfront abode for $14.95 million, according to Variety.

The performer purchased the Malibu home in 2011 for $12 million from Southern California developer Scott Gillen, according to Architectural Digest.

The home builder transformed the ’60s-era dwelling into a loftlike space with walls of glass that open to decks overlooking the Pacific Ocean.

The 5,500-square-foot, two-level home has four bedrooms and 3.5 bathrooms. The main floor features an open living and dining area, fireplace, beamed ceilings, and what looks to be a custom pingpong table.

Walls of glass open to spacious decks.

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

realtor.com

The kitchen features stainless-steel appliances, wood cabinetry, and open shelving.

A floating wood-and-steel staircase leads to the lower-level master suite, which includes a sitting area, walk-in closet, and luxurious bath.

The home also features an outdoor spa and state-of-the-art home theater.

The deck comes with plenty of seating and a fire pit. And, of course, the home is just steps to the beach.

View this post on InstagramWe have a fire pit, the ocean, and we have no idea what to do.

A post shared by Matthew Perry (@mattyperry4) on

The gorgeous beachfront property is a perfect pandemic setup.

Perry spent some quality time in the Malibu home over the past few months. He’s posted photos of himself baking cookies in the kitchen, relaxing on his deck, and complaining about mask-less beachgoers.

This isn’t the first time the actor has dipped his toe into the real estate waters. Last year, he listed his posh penthouse condo in L.A.’s Century City for a whopping $35 million. Now reduced to $27 million, the 9,300-square-foot condo features a home theater, terraces, and a massive master suite. The space, redone by the star after he bought it in 2017 for $20 million, has some personal touches, including a display of “Batman” memorabilia and a game room.

The 51-year-old apparently had another beach home in Malibu that he had opened up as a sober living facility. He sold that property five years ago for $10.65 million.

Best known for his role as Chandler Bing on the long-running sitcom “Friends,” the actor has also appeared in plays, movies, and other TV shows, including “The Odd Couple.” He was the voice of Benny in the video game “Fallout: New Vegas.” The “Friends” reunion on HBO Max, set to reunite the original cast, has been postponed due to the pandemic.

Josh Flagg of Rodeo Realty holds the listing.

The post ‘Friends’ Star Matthew Perry Lists His Malibu Beach House for $15M appeared first on Real Estate News & Insights | realtor.com®.

source https://www.realtor.com/news/celebrity-real-estate/friends-star-matthew-perry-lists-his-malibu-beach-house/

Take the Plunge Without Splashing Out: Top Affordable Lake Towns in the U.S., 2020 Edition

hauged / iStock

The dog days of late summer are when sweaty urbanites most yearn for a waterfront escape—and this year, anyone who lives in a crowded city wants out, stat. Possibly forever.

Along the coasts, folks just head to their nearest beach for some splashy fun and relaxation. But farther inland, that’s not an option. Instead, people flock to the many lakes dotting this great land, many of them unknown beyond the borders of their state. There’s no saltwater or waves to surf on, but there might be paddleboarding, kayaking, or fishing, and, in some cases, a sandy beach. And these days, a fresh-air escape is more appealing than ever.

While lake home sales were growing before the pandemic sent everyone home from the office, demand surged with COVID-19 shutdowns, says Glenn S. Phillips, CEO and lead economic analyst of LakeHomes.com, which focuses on this niche in real estate.

“People saw their friends and family go to the lake and realized that if you are social distancing and home-schooling, the lake is a far better place than most primary residences,” he says. “In addition, we have also seen some people realize that life is short, so don’t wait [to buy] that dream home.” (The same impulse, he notes, is also pushing the sale of boats, recreational vehicles, and sports cars.)

Overall, Phillips’ lake home specialists have seen sales increase over 40% from last year—and it probably would be even higher if inventory weren’t so low in so many of these waterside retreats.

But as usual, the most popular getaways tend to be expensive. With the country in a recession, even those ready to drop a bundle of cash on a second home that might end up replacing the first probably don’t want that bundle to be too big.

So where does one go without forking over the brood’s college fund?

To figure out the top affordable lake towns in the United States, the realtor.com team of data geeks scoured the site’s listings database from this spring for homes whose descriptions mention “lake” or “lake house.” Each place had to have at least 50 of these listings to make the cut, which was winnowed even further by factoring in the percentage of second/vacation homes (the higher, the better) as well as number of hotels and lodging establishments, water-based businesses, and attractions. Each category was ranked and then weighted, giving priority to price, lodgings, and seasonal-recreational homes. In order to sample the offerings from across the country, the list was limited to one place per state.

We also identified the median price for homes in these lake-affiliated towns, and while they’re all above the national median home price, we think they offer relatively good value—and we have advice on where to look for even better bargains.

Ready to dive in? Let’s take the plunge.

Tony Frenzel for realtor.com

1. Chestertown, NY

Median lake home price: $493,900

KatieDobies / iStock

This Southern Adirondack lake town is small, really small. It’s home to just 515 residents. So while it’s not exactly a vacation hot spot, it’s part of a region dotted with small lakes that has been booming this year with second-home buyers, who make up about 80% of the real estate market.

Chestertown is very close to popular and pricier Lake George as well as Gore Mountain Ski Resort, but the serene town has become far more attractive with the social distancing of COVID-19—and it costs less.

“It’s much more quaint, with smaller lakes that are clean and beautiful,” says Angie Mead, associate broker with Gallo Realty. “It’s more of a boutique lake.”

Those who want to own a home right on the water should expect to fork over at least a half-million bucks, including for this $725,000 three-bedroom. But buyers willing to share rights to the still-quiet waterfront could get in starting in the $300,000 range, like for this sweet three-bedroom log cabin with a deeded dock on private Friends Lake listed at $339,000.

2. Branson, MO

Median lake home price: $444,900

Christine_Kohler / iStock

One thing hasn’t changed this summer: Last year’s No.1 lake town is still ranking high in 2020. Branson’s usually packed Silver Dollar City theme park, Dolly Parton’s Stampede (how do you not love that woman?), and live country music shows may not be nearly as appealing during the pandemic as they have been in summers past. But there’s plenty of opportunity to distance from strangers across the area’s many lakes.

Take advantage of the 43,000 acres of Table Rock Lake on a paddleboard, kayak, or boating trip with your quarantine pod. Or spread out and fish for trout in the clean, cool waters of Lake Taneycomo. Buyers who want a quieter place to shelter might prefer the latter, where single-family homes on the water start in the high $300,000s, including this turnkey three-bedroom for $399,000 or this sprawling four-bedroom on 2.31 acres for $410,000.

3. Glen Arbor, MI

Median lake home price: $390,000

RiverNorthPhotography / iStock

This bustling town is a Midwestern summer playground with lakes in every direction. It’s nestled between Lake Michigan’s Sleeping Bear Bay and the Glen Lakes, just 10 miles north of awe-inspiring Sleeping Bear Dunes National Lakeshore. So, house hunters need not look far to find a home right near the water. Getting a contract, this year, might be another story.

Glen Arbor real estate has been moving at a feverish pace this summer, says Tim Peterson, an agent with Coldwell Bankers Schmidt, Realtors®.

“It’s about as hot a real estate market as you get in Michigan. It’s the most desired area in the state,” he says.

There are plenty of folks willing to pay to find a spot right on Glen Arbor’s gorgeous white-sand beaches. This small two-bedroom on the bay is listed for a whopping $1,950,000. But those who want similar views at a fraction of the price have plenty of options, too.

One can take in the coastal breeze from the patio of a condo starting at around $400,000, including this two-bedroom with views of the lake and Crystal River listed for $410,000 or this two-bedroom with sunset views of the bay listed for $525,000.

4. Chelan, WA

Median lake home price: $549,500

4nadia / iStock

Just a three-hour drive east of Seattle, this high-desert town is a sunny escape from the rain and clouds of the coastal Pacific Northwest. The area is popular among urbanites, with around 85% to 90% of buyers in the area seeking second homes, says Justin Skaar of Coldwell Banker Lake Chelan Broker.

It’s not hard to see why. The idyllic glacial valley surrounds crystalline waters that are so clean, many homeowners get their drinking water straight from Lake Chelan.

During the summer months, visitors and locals cruise along the shores of the 55-mile-long body of water, sailing, wakeboarding, or paddling past historic cabins and sprawling vineyards, some of which churn out some impressive local wines.

In the winter, folks get into snowshoeing, cross-country skiing, and snowmobiling.

Chelan offers a wide range of housing options at a wide range of prices. Waterfront condos start in the mid-$300,000s, including this two-bedroom listed at $349,000. But those who want private access to the water from their backdoors need IPO-level cash and should expect to fork over six figures for places like this fancy four-bedroom listed at a cool $2,050,000.

5. Gouldsboro, PA

Median lake home price: $371,500

Gouldsboro and its surrounding towns in Pennsylvania’s Poconos Mountain range have been on fire, figuratively, since the onset of the coronavirus pandemic. The folks who used to drive over for weekend trips to hike, ski, or gamble at the casinos are increasingly putting down roots.

New Yorkers and New Jerseyans have been buying in droves, seeking more space to social distance in this serene outdoor-lovers’ Eden. Around 70% of recent buyers have been coming in from out of town.

Turns out, those city dwellers can buy a single-family house for less than the cost of a studio in New York City. Entry-level lake homes start in the $100,000s, including this $155,000 four-bedroom with a giant deck. And buyers need not spend much more to find a place that’s turnkey. This beautiful three-bedroom across the street from Big Bass Lake was listed for $229,000.

The biggest problem here is finding a place to buy before someone else tries to snatch it away.

6. Vermilion, OH

Median lake home price: $557,800

Vermilion has long been one of the most beloved beach towns on the south shore of Lake Erie. Arriving by land and water, visitors flock to “Harbour Town” for a New England–style getaway without stepping foot out of the Midwest. It boasts quaint shops and restaurants that surround the town square and plenty of locals who like to watch the passers-by as they sip beverages on their front porches.

In 2020, bustling town squares aren’t what they used to be—a source of stress rather than relaxation—but the natural scenery and plethora of beaches in the area are just as appealing while you’re trying to keep 6 feet away from others.

House hunters can pick up their own little slice of the Great Lakes for under $200,000, as long as they’re willing to make some upgrades, such as this $175,000 four-bedroom across the street from the beach.

Generally, though, those who want a waterfront view should expect to spend $400,000 and up, such as for this lakefront two-bedroom with a rooftop deck listed for $499,999.

7. Wisconsin Dells, WI

Median lake home price: $437,000

This rural getaway attracts water-lovers from across the upper Midwest with its two local rivers, popular human-made Lake Delton, and around a dozen other bodies of water, with nice homes set right on the shoreline.

Halfway between Minneapolis and Chicago, the area has become a popular year-round destination for urbanites seeking an escape.

In the summer, families wakeboard, tube, and fish on the lakes and rivers—and take the kids out for mini golf and go-karts later in the day.

The winters may be harsh, but that makes it a haven for ice fishing, and the indoor waterpark is open throughout the year.

Oh, and did we mention you can get in cheap? Buyers can find three-season cottages on the water starting in the $100,000 range—as long they are willing to put in some elbow grease, like on this two-bedroom ranch with river access listed for $125,000. And condos, like this $55,000 one-bedroom, can start as low as $40,000 in some cases.

Again, the biggest problem with the Wisconsin Dells real estate market this year is actually finding a place to buy.

“A lot of people have realized that maybe they don’t want to vacation in hotels surrounded by people,” Kirkland Kettleson of Century 21 Affiliated says, driving up prices from years past. “So waterfront homes are going at a premium.”

8. Spirit Lake, IA

Median lake home price: $792,000

Midwesterners travel from near and far to relax in the gorgeous bodies of water that dot the tourist towns of Okoboji and Spirit Lakes, which consistently rank among the top affordable, lakeside real estate destinations in the United States.

Last year, Iowa’s “Great Lakes,” which are located right on the Minnesota border, reached the seventh slot on our list of top lake home destinations. The family-friendly area boasts water sports and a drive-in movie theater—talk about a prime COVID-19-era amenity—in the summer months, with plenty of hockey, ice fishing, and other outdoor winter sports during the colder parts of the year.

It’s possible to get a single-family home right on one of the smaller lakes in the $100,000s range, including this three-bedroom on Center Lake for $119,00. But those who want to be on one of the larger bodies of water like East Okoboji Lake should expect to pay more than double. There, a good deal on a single-family begins in the high $200,000s, including this five-bedroom on the market for $289,000.

9. Ely, MN

Median lake home price: $604,900

YinYang / iStock

Tucked way up north in Minnesota, remote Ely is just a short jaunt from the Canadian border as the crow flies—though driving through an international border station takes a heck of a lot longer. The glacier-carved landscape is secluded and absolutely gorgeous, full of pristine lakes and unspoiled forests.

It really is like heaven on earth for outdoor recreation with millions of acres to hike and canoe, and whatever other isolated activities one can dream up. The top tourist attractions are the International Wolf Center and North American Bear Center, if that tells you anything.

For anyone who wants some waterfront privacy, this certainly is the place. Buyers can get acreage—not just lots—in the $200,000 range, such as this $225,000 one-bedroom log cabin overlooking Shagawa Lake. And for $600,000, it’s possible to buy a cabin on a private island, reachable by boat via the two docks.

10. Hot Springs Village, AR

Median lake home price: $627,800

Hot Springs Village—not to be confused with the city of Hot Springs and its namesake national park, 17 miles to the south—is the largest gated community in the United States. The 26,000-acre, census-designated place boasts nine golf courses, dozens of restaurants, 14,000 residents, and 11 lakes with plenty of single-family houses and townhomes on the shores.

Residents, many of whom move to the village for retirement, spend their days paddleboarding, fishing, and swimming in the lakes or walking along 30 miles of forested trails.

Waterfront townhomes start in the mid-$100,000s, including this two-bedroom for $168,000. Buyers willing to spend a bit more can find huge spreads like this three-bedroom on more than an acre right on the edge of Lake Desoto listed for $454,900.

Like in many other desirable lake towns around the United States, there aren’t a ton of entry-level waterfront homes for sale at the moment, but single-families right on the water often start in the $300,000 range, says Deb Seibert, an agent with Hot Springs Village Real Estate, who raised three boys in the community over 36 years there: “It’s a wonderful lifestyle for not a lot of money.”

The post Take the Plunge Without Splashing Out: Top Affordable Lake Towns in the U.S., 2020 Edition appeared first on Real Estate News & Insights | realtor.com®.

source https://www.realtor.com/news/trends/take-the-plunge-without-splashing-out-top-affordable-lake-towns-in-the-u-s-2020-edition/

Friday, 28 August 2020

Historic Castle With Old-World Charm Is Just as Ideal for New-World Living

realtor.com

It is possible to live in a historic castle for less than a million dollars.

A 7,500-square-foot, European-style castle on Fairway Lane is available for $950,000 in Alliance, OH. Completed in 1930, the 26-room castle is listed on the National Register of Historic Places.

“It has seven levels to the house, all of which are above grade. It’s very unique. It’s not just a traditional two-story-style house,” says listing agent Joanna Belden.

“It has just been beautifully maintained and I think that’s why you kind of feel like you’re taking a step back in history,” says Belden. “It reminds me of something that you might have found in France. It has a feeling of grandeur in that way, but at the same time it’s a really comfortable property.”

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Robert and Elizabeth Purcell built the castle in the late 1920s in a French Normandy style. Soon after the construction, Robert, an aviator and industrialist, died in a plane crash in 1932. He was 29. His young widow did not stay in the mansion after his death, and it sat vacant for most of the 1930s.

The current (and seventh) owners used the property as a bed-and-breakfast as well as an entertainment and wedding venue. After living on the property for 25 years, they are getting ready to retire, Belden explains.

“When you walk into this house, everything that’s been done in terms of any improvements, remodeling, or changing was done in keeping with the original integrity and character of the home,” Belden says. “You don’t walk in and feel like something doesn’t fit. There are still some of the original light fixtures and the flooring and the brick walls and the beams and the carvings. Most of everything that’s there was part of the original structure of the property.”

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Dark wood runs throughout the house, some of it intricately carved.

Carved wooden gargoyles, a horned frog, and fire-breathing dragon guard an entryway. Two life-size noblemen stand guard next to a fireplace. The fleur-des-lis, the symbol of the French monarchy, can be found throughout the home.

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

The house has five bedrooms and 6.5 bathrooms. Three of the bedrooms have carved wooden beds with gargoyles and floral motifs. The bathrooms have all been updated while maintaining historical style.

“They are done in a way that doesn’t detract from the original intent of the home but allows you to live in it,” Belden says, noting that two of the three fireplaces have been converted to gas.

“There have been a lot of things that have been done that allow you to live in it comfortably, but it still has that old-world feel,” she adds.

Jeremy Aronhalt/ A Studio

The home is built in an L-shape with a round tower where two wings meet.

A library sits atop the tower and offers views of the gorgeous grounds. The property’s 13 acres include manicured gardens and a stocked pond.

Jeremy Aronhalt/ A Studio

The kitchen has both original cupboards and modern appliances. On the floor below are the pub room and wine cellar. There’s also a ballroom and exercise room.

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Woods surround the property on three sides and the Alliance Country Club adjoins the property on the other. Canton is only 18 miles away, and Cleveland and Pittsburgh are only an hour away.

Jeremy Aronhalt/ A Studio

“Our cost of living is relatively low and the cost of real estate is low comparatively to many other places in the country. Which is why I think we’ve seen sort of a surge of people buying in this area,” Belden explains.

“If this house was in a different part of the country, it could easily be a $2.5 million property.”

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

Jeremy Aronhalt/ A Studio

The post Historic Castle With Old-World Charm Is Just as Ideal for New-World Living appeared first on Real Estate News & Insights | realtor.com®.

source https://www.realtor.com/news/unique-homes/historic-ohio-old-world-castle-perfect-for-new-world-living/